Mining cryptocurrencies such as Bitcoin, Ether and Litecoin at the top of the market cap is certainly not profitable in itself. Personal computers, even with high-performance graphics cards, are not fast enough to allow miners to mine digital currencies at a profitable rate. Besides, it should not be forgotten that the process consumes a lot of energy.

Moreover, cryptocurrency rewards are only awarded to the first miner who reports decrypting the header of a block. In “collision mining”, where mining rewards are distributed in a distributed manner, the miner is rarely the first to transmit.

Note that this reward decreases over time. This phenomenon is known as bifurcation. In the case of the Bitcoin blockchain, adding a new block to the network will cost 6.25 BTC in the mid-2020s; for every 210,000 blocks, the reward will be halved; in 2024 it will drop to 3.125 BTC.

However, that doesn’t mean you can’t mint digital coins at home. You can mine an unpopular cryptocurrency on a private device and consider yourself lucky if the asset’s popularity suddenly increases: Dogecoin is an example. The price of this cryptocurrency has been rising for months and its holders can sell it at a bargain price.

How to start mining cryptocurrencies? The best method.

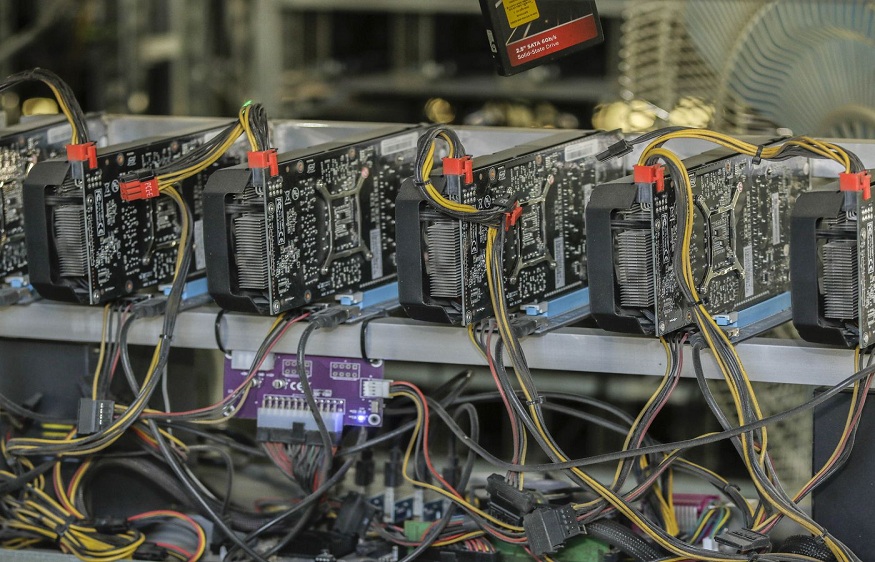

There are several ways to start your mining adventure. The most well-known of these is cryptocurrency mining using the special equipment mentioned above. However, this does not guarantee the rewards of solo mining.

Therefore, the solution is to join a mining team. This is a consortium of miners who combine the fragmentation speeds of their machines to mine a network of separate blocks in a short time and cost-effectively. The royalties received by the mining cooperative are distributed among the members of the cooperative according to their share of the fragmentation power. Mining cooperatives can be connected through applications that connect to the pool, such as Miner Gate.

Both of the above methods are part of a mining method called Proof of Work (PoW), which means that the miner or group that uses the most computing power to mine cryptocurrency receives a reward. In both cases, it is not necessary to allocate digital currency funds to mine more blocks in the online chain. It is still necessary to invest in hardware.

The opposite of PoW is Proof of Stake, PoS, which requires owning and depositing a sufficient amount of cryptocurrency for a certain period of time.

How to mine cryptocurrencies

Mining can be done in three ways. The first option is to rent a virtual server; the second is to create your own wallet (this is possible with a fast SSD, plenty of RAM and a computer with 24/7 internet access that you can purchase directly from Atlantek Computers Online Shop ); the third is to use the computing power of the cloud to mine the method. To do this, you have to pay a fee set by the mine.

The disadvantage of the last method is that the actual mining volume cannot be monitored. Many of these projects are fraudulent, as they collect money from customers and then disappear without a trace.

The advantage of POS is that you don’t have to buy expensive equipment and there is no high electricity bill. The disadvantages, on the other hand, are the aforementioned lack of control over mining power, uncertainty due to accidental withdrawals and the need to hold large amounts of cryptocurrency that cannot be moved. This last disadvantage is related to another problem of PoS, namely that cryptocurrencies cannot be used for the purposes for which they were created as financial assets. In fact, it is more profitable to hold them for mining than to pay for them or play with them on an exchange.

Is it legal to mine cryptocurrencies?

Yes, you can mine cryptocurrencies legally in most countries around the world. This is also the case in Poland. There are only a few countries in the world where mining is prohibited. These countries are Algeria, Bolivia, Egypt, Egypt, Ecuador, Morocco, Nepal and Pakistan.

The reason for the ban in these countries is to combat usury. China has adopted a similar approach. It bans the trading of cryptocurrencies. Mining itself is not.

Conclusively, we can expect that free countries like Ireland, where we have access to extremely fast fibre broadband connections, as well as computer equipment, will create no legal impairment to mine cryptocurrencies.

Now you know how to get your hands on crypto-currencies. It’s a way to get rich. But it’s not always profitable, especially when it comes to the most popular digital currencies. Before deciding to become a crypto-currency miner, it’s a good idea to weigh the pros and cons. The destination is also important. The Dogecoin story shows that luck is needed, just like in any other industry.